- Bullfinder AI

- Posts

- Wrap Up: 2025's Best Movers & What's Next...

Wrap Up: 2025's Best Movers & What's Next...

This years' biggest movers, and what's setting up best for 2026

With 2025 quickly coming to a close and 2026 in the headlights, we’d like to thank all our readers for their ongoing support over the past year.

We hope that the information contained within our articles helped bring you a few fresh perspectives, ideas and renewed hope for future success on the financial markets and we appreciate everyone that has passed our writings on to others.

In this edition of Bullfinder AI Insights, we review some of 2025’s standout performers, and what could be next for 2026…

The Standouts - Commodities:

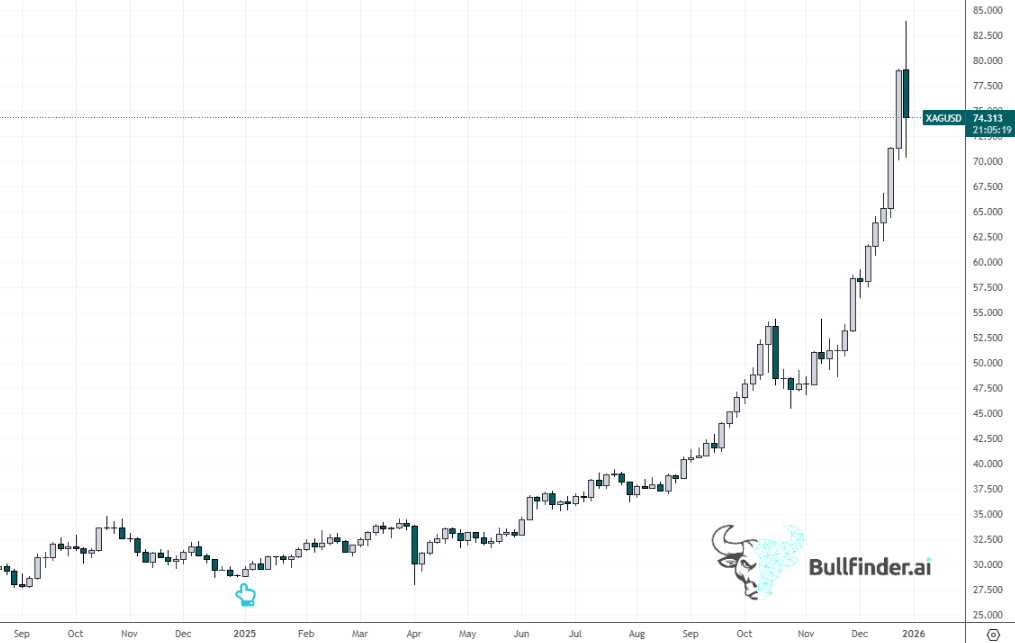

Coming in at #1 - Silver

During the 2025 calendar year, Silver futures experienced upside of +176% at its peak, and is currently sitting up +157% for the year.

2025 Price Summary - Silver:

2025 low - $27.545

2025 Peak - $82.67

Current price - $74.313

Silver’s meteoric rise over 2025. Charts by TradingView.

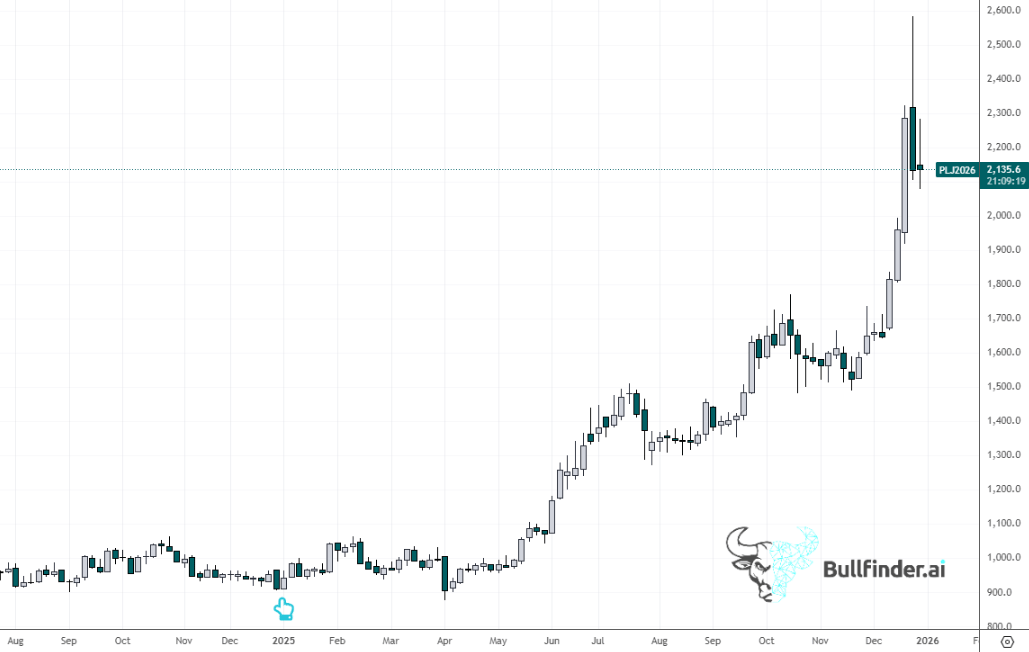

Coming in at #2 - Platinum

During the 2025 calendar year, Platinum futures experienced upside of +174% at its peak, and is currently sitting up +135% for the year.

2025 Price Summary - Platinum:

2025 low - $878.3

2025 Peak - $2,584.4

Current price - $2,131.5

Platinum’s stellar run over 2025. Charts by Tradingview.

Coming in at #3 - Palladium

During the 2025 calendar year, Palladium futures experienced upside of +130% at its peak, and is currently sitting up +79% for the year.

2025 Price Summary - Palladium:

2025 low - $870.5

2025 Peak - $2,129.0

Current price - $1,620.0

Palladium’s staggered rise over 2025. Charts by TradingView

Other Notable 2025 Movers - Commodities (peak change):

Gold +73%

Hydrogen +110%

Uranium +107%

Rare Earths +96%

Notable 2025 Losers - Commodities (peak change):

Frozen OJ -47.68%

Crude Oil -39.2%

Cocoa -46.74%

Rice -29.70%

Note for 2026:

Particularly regarding Gold & Silver, 2025’s performance reflects ‘mania’ style behaviour. We urge all of our readers to address these markets over the next few years with an ere of caution.

The Standouts - Fiat Currencies:

Next, we look at which traditional Currencies outperformed & which underperformed over 2025…

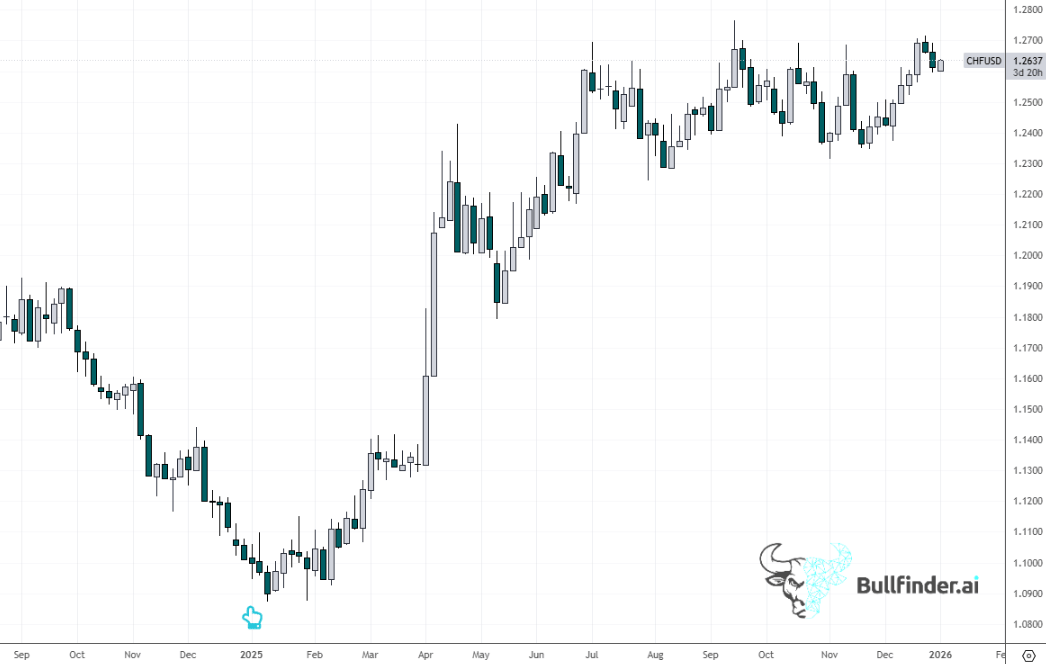

2025 Top Performer (Fiat Currency) - Swiss Franc (CHF)…

2025 was a Swiss Franc dominant year, hitting a peak of +16.20% on value average across a basket of pairs, and reaching a peak of +16.02% against the US Dollar.

2025 was a CHF dominant year. Charts by Tradingview.

Other Notable 2025 Movers - Currencies (peak change):

Euro +14.50%

British Pound +9.90%

Australian Dollar +7.08%

Canadian Dollar +5.94%

2025 Worst Performers (Fiat Currency):

Mexican Peso -12.53%

New Zealand Dollar +1.38%

Japanese Yen -0%

The Standouts - Major Stock Markets

After 2 consecutive years of strength, major stock markets saw a considerable gain in 2025 yet again, with the S&P500 finishing +16.06%.

…but it wasn’t all smooth sailing, with major indices such as the S&P500 and NASDAQ first experiencing sharp falls of -19.18% and -23.47% respectively in Q1 of 2025 CY as a consequence of market pricing in trade & tariff related risk.

Other Top Performing Major Markets:

NIKKEI +29.35%

RTSI +28.07%

DAX +23.13%

FTSE +22.18%

A50 +18.60%

Note for 2026:

2025’s performance represents 3 consecutive years of significant growth in major indices without a major period of consolidation. We urge all of our readers to enter the next few years with an ere of caution.

The 2025 Reality Check - Cryptocurrencies

After multiple consecutive years of strength, 2025 was a year of profit taking across the vast majority of crypto coins as investors looked for alternative instruments with high performance potential but which carried lower risk and/or provided greater security.

Big Name Highlights:

BTC -10.16%

ETH -18.78%

SOL -41.28%

ADA -67.01%

DOGE -67.48%

Diamonds in the Rough:

BNB +20.25%

XMR +131.10%

Note for 2026:

As risk appetite seems to be shifting to more conservative options across worldwide markets, cryptocurrencies in 2026 pose an interesting argument however the success of which will be largely dependant on inflation and the stability of the general market. If more traditional safety is sought, 2026 may not be their year.

One consideration however is that market participants do seem to be treating certain crypto coins favourably, particularly those with privacy aspects to their technology such as XMR.

A year of stellar performance across the board…so why didn’t your portfolio perform?

With so many big name stocks, and so many well-known commodities gaining significantly in value…Why did so many still struggle to grow their portfolios meaningfully this year?

If this relates to you, one of the reasons could be found in how you’re interacting with the markets - Either to a high standard and in a professional manner, or, lazily and for entertainment purposes.

If you want to empower your skillset for the next year of market movements, reply with “MRM” and we’ll get you started on the right track so you too can begin to look in the right place, at the right time, and this time, find the next bull, before it runs.

Enjoy this article?

The greatest compliment is sharing Bullfinder.ai with a friend.

Bullfinder AI Disclaimer…

Please be advised that all Bullfinder, Bullfinder AI, BullfinderAI, Bullfinder-ai, Bullfinder-official, bullfinder_ai & bullfinder.ai content, is strictly for informational and educational purposes only. Any and all content should not be considered as financial advice, recommendations, or solicitations to engage in any investment activity. You should not make any decision, financial, investment, trading, or otherwise, based on any of the information presented without undertaking independent due diligence and formal consultation with a licensed professional, be that your financial advisor and/or professional broker, as mentioned instruments may not be suitable for your personal circumstances. Past performance is not a reliable indicator of future results. Bullfinder.ai will not be held liable for any losses incurred via trading & investing beforementioned instruments. Please review ‘terms of service’ on our home page before continuing to engage with our content. By continuing, you agree & accept our terms of service.